|

Section II. Compliance record

Criteria:

An appropriate record of compliance with customs requirements

The applying economic operator, the persons in charge of the company or exercising control over its management, and, if applicable, the applicant's legal representative in customs matters and the person responsible in the company for customs matters have not committed a serious infringement or repeated infringements of customs rules over the last 3 years preceding the submission of the application. If the applicant has been established for less then 3 years, his compliance shall be judged on the basis of records and information that are available.

The applicant's compliance shall be judged on the basis of the records of the customs administration, including intelligence information and results of anti-fraud investigations. If the persons exercising control over the management of the applicant are established or located in a third country, their compliance shall be judged on the basis of records and information that are available.

Note: The information of the two following sub-sections can mainly be gathered by the customs authority itself, on the basis of information from various sources within the customs administration including national and international enforcement agencies.

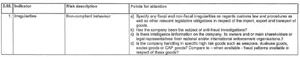

Sub-Section 2.01 Compliance history as regards customs authorities and other relevant governmental authorities

| (拡大画面:78KB) |

|

|

|

|

| (拡大画面:116KB) |

|

|

|

|

|

4 Compliance checks are for instance: audits, pre clearance checks, post clearance controls

|

Sub-Section 2.02 Intelligence Information

| (拡大画面:95KB) |

|

|

|

|

Section III. The Company's Accounting and logistical system

Criteria:

A satisfactory system of managing commercial and where appropriate, transport records, which allow appropriate customs controls

The applying company should maintain an accounting system which is consistent with the generally accepted accounting principles applied in the Member State where the accounts are held and which will facilitate audit-based customs control.

To enable the customs authorities to apply the necessary controls, the company has to allow the customs authority physical or electronic access to the customs and, where appropriate, transport records. Electronic access is not a pre-requisite to comply with this requirement.

The applying company should have a logistical system which distinguishes between Community and non-Community goods, the fulfilment of this criterion is not needed in the case of an AEO Certificate - Security and Safety;

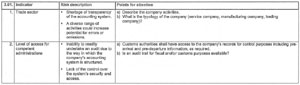

Sub-Section 3.01 Audit trail

In accounting, an audit trail is a process or an instance of cross-referring each bookkeeping entry to its source in order to facilitate checking its accuracy. A complete audit trail will enable to track the lifecycle of operational activities, in this respect related to the flow of goods and products coming in, being processed and leaving the company. Many businesses and organizations require an audit trail in their automated systems for security reasons. The audit trail maintains a historical record of the data that enables you to trace a piece of data from the moment it enters the data file to the time it leaves.

| (拡大画面:65KB) |

|

|

|

|

Sub-Section 3.02 Accounting system

| (拡大画面:76KB) |

|

|

|

|

| (拡大画面:168KB) |

|

|

|

|

|