2.2 Price developments

Table 1 - Evolution of prices for newly built ships (yearly averages in Millions of US Dollars)

| |

1997 |

1998 |

1999 |

| Panamax Container Carrier |

53.0 |

42.0 |

38.0 |

| 1100 TEU Container Carrier |

20.0 |

18.0 |

17.5 |

| Very Large Crude Oil Carrier (VLCC) |

83.0 |

72.5 |

70.0 |

| Capesize Bulk Carrier |

40.5 |

33.0 |

37.0 |

| Panamax Bulk Carrier |

27.0 |

20.0 |

22.8 |

| Tweendecker 15,000 dwt |

16.5 |

14.0 |

13.0 |

Source: Clarkson World Shipyard Monitor.

Table 2 - Evolution of prices for newly built ships (annual changes in percent)

| |

1997/1998 |

1998/1999 |

1997/1999 |

| Panamax Container Carrier |

-20.75% |

-9.52% |

-28.30% |

| 1100 TEU Container Carrier |

-10.00% |

-2.78% |

-12.50% |

| Very Large Crude Oil Carrier (VLCC) |

-12.65% |

-3.45% |

-15.66% |

| Capesize Bulk Carrier |

-18.52% |

12.12% |

-8.64% |

| Panamax Bulk Carrier |

-25.93% |

14.00% |

-15.56% |

| Tweendecker 15,000 dwt |

-15.15% |

-7.14% |

-21.21% |

Looking at the average prices for certain important shiptypes in the years 1997 to 1999 it is clear that the increased demand from 1998 to 1999 (see Fig. 3) generally had no positive impact on prices. On (numerical) average prices for new ships have declined by 17% since 1997.

The notable exceptions are Capesize and Panamax bulk carriers which have seen a slight price increase since 1998 by 12% and 14%, respectively. Nevertheless prices for these shiptypes are still considerably lower than in 1997. The reasons for this movement in prices for bulk carriers could be seen in the situation of the South Korean Halla yard which has a focus on the production of these vessels. Halla has played the role of a price leader, offering extremely low prices in order to fill the massive capacities created at the Samho production site. As elaborated in Annex II of the first report Halla has been in financial difficulties since 1997. To solve these problems and save the yard, the Hyundai group has agreed to a management co-operation scheme in which Hyundai would take over management responsibility in return for a fixed share of future profits. Moreover, Halla would receive more debt reduction through the domestic creditors (mostly government-controlled banks) before Hyundai would take over Halla fully. In this context Hyundai has demanded from Halla to renegotiate ship prices which were considered as too low even by Korean standards. It is not known in how far Halla has been successful in the re-negotiation but this could have had an impact on prices for these particular shiptypes.

All other important shiptypes have seen further price erosion and prices for the end of 1999 are again lower than the yearly averages for some shiptypes (Capesize bulk carrier: 35 Mio. USD; Panamax bulk carrier: 22 Mio. USD; VLCC: 69 Mio. USD[prices for December 1999; source: Clarkson World Shipyard Monitor]).

2.3 The market segment of containerships

As discussed in the first report, container vessels represent the largest market segment in commercial shipbuilding in terms of cgt and container ships have been a major product of Japanese and EU yards in the past. The first report also stated that Korean yards have made very significant inroads into the market for container vessels since 1997. This trend has continued and concerning this particular market segment the situation presents itself as follows:

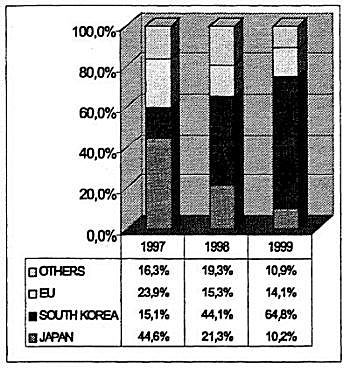

Fig. 5 - Market shares in new orders for containerships in percent and based on cgt, 1997 - 1999 (Source: Lloyd's Register of Shipping)

South Korea has consolidated its dominant position in the building of containerships and has further cut into EU and Japanese market shares. It has also taken market share from the group of "others" which in this segment is represented by countries such as China, Taiwan and Poland. Although most of the market share gained seems to be at the expense of Japanese yards it should be noted that most of the orders in question come from EU operators. In the meantime price levels have further deteriorated as described above which has led two Japanese operators of container lines (K-Line and NYK) to place major orders in Korea. Given the traditional preference of Japanese owners for domestic ordering this clearly shows that Korea's low offer prices have been changing the market dramatically. The EU position seems to weaken constantly in this market segment, only slightly offset by the 20% decrease in the value of the euro since January 1999. As the Yen has seen a significant appreciation in the past year this has added to the problems encountered by Japanese yards. It should be kept in mind that an appreciation of the euro would quickly bring the EU shipbuilding industry into an equally dramatic situation as the yards in Japan. On the other hand an appreciation of the Korean Won may not necessarily shift market share away from Korea if it is not accompanied by a behavioural change on the side of the Korean shipyards.

2.4. Conclusion

The general market analysis within this second report from the European Commission confirms the findings of the first report, namely that

- Over-capacities in the shipbuilding market exist but there is no agreed analysis between Japan and the EU on the one side and Korea on the other about the extent of these over-capacities and their impact on the market situation. However, in the "Agreed Minutes" Korea for the first time acknowledges the necessity to address the problem.

- South Korean capacity expansion, especially in the period 1994 to 1996, has been the main reason for the continuing and growing imbalance. Although three Korean chaebols active in shipbuilding (Hyundai, Daewoo and Samsung) have recently announced reductions in their exposure to shipbuilding in order to focus more on other industrial activities and "improve the groups' profitability" this does not mean cuts in production capacity, according to the Korean Shipbuilders Association. At least for Hyundai Mipo the indications point in a different direction with repair capacity increasingly being used for ship newbuilding. Moreover Hyundai will expand capacity further through the inclusion of the ailing Halla / Samho yard in the group's shipbuilding activities. It was recently announced that Samho would re-open its second building dock following strong demand for certain shiptypes.

- Prices have declined further, in particular for ship types for which Korea competes aggressively, bringing demand forward and massively shifting market shares to Korean yards. Most significant is the shift in market shares with regard to container vessels where Korea now holds a dominant position, in particular as far as the biggest and technically most advanced vessels are concerned.

- Korean expansion has been at the expense of all other major shipbuilding regions, with Japan taking the biggest losses. The situation of the EU shipbuilding industry remains critical, only slightly offset by the cruise ship boom, the comparatively good orderbooks and the devaluation of the euro against the US Dollar.