2. General Market Analysis

Demand and Supply

The world shipbuilding market has been in imbalance over a long period of time and all relevant market participants expect this situation to persist and even deteriorate. The demand side in particular is now widely considered to be on a longer-term downturn. As can be seen in Figure 1 the supply forecasts continue to exceed the demand forecasts. Although the major shipbuilders' associations AWES(Association of European Shipbuilders and Shiprepairers) and SAJ (Shipbuilders' Association of Japan)on the one hand, and KSA (Korean Shipbuilders' Association) on the other, see future demand and supply at different levels (with demand in general staying stable), and though they also have different opinions regarding the volume of the resulting lack in demand, both sides agree that the gap between supply and demand will widen.

The total new building capacity world-wide currently amounts to nearly 20 Mio. cgt (compensated gross tonnes, a measurement combining ship size and shiptype-specific building effort). Total new shipbuilding orders were 20.935 Mio. cgt in 1997 and 18.359 Mio. cgt in 1998. For the first half of 1999 new orders of 7.86 Mio. cgt were reported, which indicates that demand is indeed increasingly out of line with supply and that 1997 and 1998 were exceptional years with regard to the demand/supply ratio.

Fig.1* Completed ships 1985-1998, supply and demand forecasts by AWES/SAJ and KSA, in Mio. cgt

* The data underlying the graphical representations and the source references can be found in Annex III.

It is notable that production in 1998 had only reached the level of 1978 after many years of decline.

Moreover 1998 was a year that saw a high number of orders and completions, partly due to an abnormal decrease in prices since the beginning of 1997 and a booming demand for passenger vessels as the cruise market continued to expand.

Under these conditions stable market conditions are unlikely to evolve soon, unless new building capacity is removed from the market on a significant scale.

The most disturbing element is the steep decline in prices for newly built vessels (see next paragraph)which has a significant impact on demand. Ship owners react to historically low prices by placing orders that can be considered a "bet on the future", i.e. at higher prices some ships would be ordered only later or not at all. It can be expected that this type of additional demand in recent years will be compensated by a significantly lower demand later which makes it difficult for shipyards to keep a balanced order book and a consistent level of employment.

The supply side of the market is still dominated by three major regions: South Korea, Japan and the EU which take a combined market share of some 80%. This report therefore focuses on these regions and their most important shipbuilding products. Niche markets and shipbuilding activities outside the three main regions will not be addressed here.

Fig.2 Available building capacities in Japan, Korea and the EU in thousands of cgt, 1988-1997

Shipbuilding capacity in Korea has grown from around 1.7 Mio cgt in 1988 to 4.6 Mio cgt in 1997(+170%). In the same period capacities in the EU have been reduced from 4.4 Mio cgt in 1988 to 3.1 Mio cgt in 1997 (-29.5%). Capacities in the third major shipbuilding area, Japan, have remained stable at 5.6 Mio cgt. The increase on the supply side has mainly to be attributed to South Korean expansion since 1994. As Korea did not report figures on cgt capacities to OECD in the past, these figures were calculated from completed gross tonnes using varying conversion factors which reflect the evolution in the product mix of Korean yards (see Annex III).

Price Developments

As already mentioned prices for new vessels have suffered severely as capacities were increased, and some competitors are desperate to attract orders to fill these capacities. Specific cases in this regard will be discussed in chapter 3. It is obvious that the decline in achievable prices is not homogeneous: different shiptypes are used in different business environments, freight rates (as a major parameter for the attainable return on investment) depend on the commodities and the trading areas in question, and shipowners show different attitudes depending on the particular market. The table below gives some indications on the decline in prices for some selected shiptypes which can be considered as representative for the bulk of new merchant ships. The prices are calculated averages, derived from available contract information. Prices have gone down across the board and have now reached a level that in many cases do not allow shipyards to cover operating costs.

Table 1 Evolution of prices for newly built ships (in Millions of US Dollars)

| |

1997 |

1998 |

March 1999 |

| Panamax Container Carrier |

53.0 |

42.0 |

37.5 |

| 1100 TEU Container Carrier |

20.0 |

18.0 |

17.0 |

| Very Large Crude Oil Carrier (VLCC) |

83.0 |

72.5 |

69.5 |

| Capesize Bulk Carrier |

40.5 |

33.0 |

31.5 |

| Panamax Bulk Carrier |

27.0 |

20.0 |

18.5 |

| Tweendecker 15,000 dwt |

16.5 |

14.0 |

13.5 |

Source: Clarkson World Shipyard Monitor.

1997 and 1998 prices are the average of reported prices in the respective years. For 1999, prices are the average reported prices during the first quarter of that year.

Table 2 Evolution of prices for newly built ships (annual changes in percent)

| |

1997/1998 |

1998/1999 |

1997/March |

| Panamax Container Carrier |

-20.75% |

-10.71% |

-29.25% |

| 1100 TEU Container Carrier |

-10.00% |

-5.56% |

-15.00% |

| Very Large Crude Oil Carrier (VLCC) |

-12.65% |

-4.14% |

-16.27% |

| Capesize Bulk Carrier |

-18.52% |

-4.55% |

-22.22% |

| Panamax Bulk Carrier |

-25.93% |

-7.50% |

-31.48% |

| Tweendecker 15,000 dwt |

-15.15% |

-3.57% |

-18.18% |

The biggest price decreases are recorded with Panamax bulk carriers and Panamax container vessels. Both types of ships are very important to the Korean shipbuilding industry in general and to some investigated yards in particular. This report will try to indicate the extent to which these market segments have been targeted by Korean competitors and how this has affected prices (and consequently created an "artificial demand").

It should be noted that this significant decline in prices, affecting all major shiptypes, not only threatens the profitability of shipyards, it also poses problems to the shipping community as tonnage ordered before the price decline needs to be reassessed in its asset value. With a lower asset value creditors ask for additional collateral coverage, thereby increasing financing costs and cutting into the profits of ship owners.

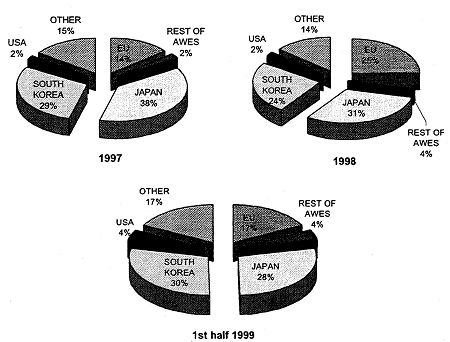

Market Shares

As a consequence of the fierce competition in the shipbuilding market and the dramatically lower prices, market shares have shifted. Figure 3 shows the breakdown of market shares by countries and regions for the period 1997 to the first half of 1999. It can be argued that this period was exceptional for various reasons, however, it would be beyond the scope of this report to analyse the market movements in a larger timeframe. A wider perspective would also not change the overall picture of a market in difficulties.

Fig. 3 World market shares by country/region (new orders, based on cgt), 1997, 1998 and 1st half of 1999

The significant increase of EU market share in new orders in 1998 was due to the Asian crisis and the financing problems that came with it and cannot be considered as part of a larger trend. There were almost no orders awarded to South Korean shipyards in the first half of 1998 as owners took a "wait and see" position and banks were unable to provide financing. This makes the recovery of Korean market share in the second half of 1998 even more remarkable. As can be seen, Korean market share is on the rise again after the specific financing problems and economic uncertainties in 1998 were overcome. South Korea has now its largest market share ever and has also overtaken Japan (a declared objective of the Korean government and industry). China has also managed to increase market share which is reflected in the increase of "others". The USA plays a minor role in world shipbuilding, but various protectionist elements (Chapter XI, Jones Act, navy orders) assure that US yards are able to stay in business and could, under certain conditions, come back into commercial shipbuilding in the future. Information on completed tonnage shows a similar structure; the relevant data can be found in the annexes.

Japan which until now has been able to "buffer" the negative market trend through domestic demand, has seen a decline of some 20% in new orders in the first six months of 1999. As a result yards have started to reorganise and there is persistent talk of consolidating the seven major Japanese shipyards into four groups. The EU' s market share decreased in the first half of 1999 which is in line with the longer term trend. EU shipyards are coming under increasing pressure which is also reflected in the fact that the British-Norwegian Kvaerner Group (Europa's largest shipbuilding group) decided in early 1999 to sell all its shipbuilding operations, claiming that the return from shipbuilding operations was too low to keep them attractive to Kvaerner's investors and shareholders. Moreover two shipyards in Europe have been closed or are about to close (Aarhus Flydedok in Denmark and Les Ateliers et Chantiers du Havre in France, respectively).

Market Composition

Figure 4 provides a snapshot of the distribution of ship types ordered in 1998. The largest market segments are those for crude oil tankers, bulk carriers, product/chemical carriers, general cargo ships, container vessels and passenger ships. EU yards which have basically ceased to produce ships in the large volume market segments of crude oil carriers, bulk carriers and general cargo ships are now also facing increasing competition in the segments of product/chemical carriers, ferries and full container ships. Only passenger ships and some types of ferries remain areas in which Europe dominates because EU yards are technological leaders and therefore still attract the majority of orders. It should, however, be noted that a major EU cruise operator has recently awarded two important contracts to a Japanese shipyard which could ultimately endanger the dominant market position that EU yards still enjoy. EU yards have continuously lost market shares to Asian competitors even in segments which they traditionally dominated, despite major efforts to innovate and to raise productivity.

Fig. 4 World market shares by shiptype (orders, based on cgt), 1998

The Container Ships Segment

In terms of cgt, container vessels represented the largest market segment in 1998. Container ships have been a major product of Japanese and EU yards in the past and they are the "backbone" of world liner shipping. European yards have had a particular expertise in very large container ships (Post-Panamax), as these vessels are technologically demanding and follow different and more complex design paradigms.

As Korean competitors are obviously targeting the whole container ship market segment, this merits a closer look. Figure 5 shows the development in market shares for Japan, South Korea and the EU and the overall order volume in 1997, 1998 and the 1st half of 1999.

Fig. 5 Development of market shares for Japan, South Korea and the EU in container vessels (orders, based on cgt), 1997 to the first half of 1999

Korean yards have made very significant inroads into the market for container vessels since 1997. Although the statistics indicate that Korean yards have expanded market share at the expense of Japanese and other non-EU competitors, EU shipyards have clearly failed to participate in the 1998 order boom on the same scale as Korea, and seem bound to concentrate on maintaining their comparatively low market share of ca. 15% whereas the Korean share has now reached nearly 70% in terms of cgt. It should be noted that overall orders (world total in cgt) for container vessels increased by 30% from 1997 (2.43 Mio. cgt) to 1998 (3.16 Mio. cgt) and stood at 1.12 Mio. cgt for the first half of 1999.

There is concern that the developments in the market for container vessels could be repeated for ferries and cruise vessels. Asian competitors have a track record of attracting orders for sophisticated tonnage through extremely low prices, hoping that they will improve their technical abilities in the course of the project and gain the reputation that is needed to attract more orders. In the case of the two cruise vessels ordered in Japan, there are clear statements from the building yard that the order does not have to be profitable as long as the yard is able to deliver the quality that the market demands, thus putting the yard on the map of cruise operators. The investigated ferry order at Samsung (see chapter 3) seems to follow the same business strategy.

Conclusions for Chapter 2

■ Overcapacities in the shipbuilding market exist and are very likely to grow due to both decreasing demand and increasing supply.

■ South Korean capacity expansion, especially in the period 1994 to 1996, has been the main reason for the continuing and growing imbalance, and Korean yards have great difficulties in attracting a sufficient number of orders to cover costs.

■ Prices have plummeted in particular for ship types for which Korea competes, bringing demand forward and shifting market shares to Korean yards. Most significant is the shift in market shares with regard to container vessels where Korea is probably nearing a dominant position. China which is seen by many as a future shipbuilding power has also increased market share in the period covered by this report.