2.2. Price developments

In the second and third quarter of 2000 prices in certain market segments started to recover from the very low levels seen after the Asian crisis in 1997. This mainly concerned liquid and dry bulk carriers, gas carriers and, to some extent, containerships. With improved freight rates due to a higher oil price or expanding trade, respectively, owners were willing to pay a premium, in particular when early delivery of the vessels could be secured.

Market analysts such as Clarkson Research report prices for main shiptypes on a monthly basis. This information has become something of a benchmark, in particular for ship brokers, although other sources of prices are available such as from Lloyds Shipping Economist. It should be noted that Clarkson information is extensively used by the Korean Shipbuilders Association as evidence for a recovering market. The latest information is summarised in the following tables, taken from the December 2000 issue of "Clarkson World Shipyard Monitor". The tables compare prices at the end of 1999 with those prevailing in November 2000 firstly for bulk shiptypes and secondly for other shiptypes (referred to as specialised vessels by Clarkson Research).

Table 1 - Clarkson Research price data for bulk shiptyppes (to November 2000)

| Shiptype |

Price (Mio,USD) |

Change |

| 1999 |

2000 |

| Tankers |

VLCC |

300 000 dwt |

69,0 |

76,0 |

10,0% |

| Suezmax |

150 000 dwt |

42,5 |

52,0 |

22,4% |

| Aframax |

110 000 dwt |

33,0 |

41,0 |

24,2% |

| Panamax |

68 000 dwt |

31,0 |

35,5 |

14,5% |

| Handy |

47 000 dwt |

26,0 |

29,0 |

11,5% |

| Bulkers |

Capesize |

170 000 dwt |

35,0 |

40,0 |

14,3% |

| Panamax |

75 000 dwt |

22,0 |

22,0 |

0,0% |

| Handymax |

51 000 dwt |

20,0 |

20,5 |

2,5% |

| Handysize |

30 000 dwt |

15,5 |

15,0 |

-3,2% |

Table 2 - Clarkson Research price data for specialised shiptypes (to November 2000)

| Shiptype |

Price (Mio,USD) |

Change |

| 1999 |

2000 |

| LNG carrier |

138 000 m3 |

165,0 |

172,5 |

4,5% |

| LPG carrier |

78 000 m3 |

56,0 |

60,0 |

7,1% |

| Container |

400 TEU |

8,5 |

10,0 |

17,6% |

| Container |

1 100 TEU |

17,5 |

18,0 |

2,9% |

| Container |

3 500 TEU |

38,0 |

41,5 |

9,2% |

| Ro/Ro |

1 200 - 1 300 lm |

21,5 |

20,0 |

-7,0% |

| Ro/Ro |

2 300 - 2 500 lm |

32,5 |

33,0 |

1,5% |

| Tweendecker |

15 000 dwt |

13,0 |

13,8 |

6,2% |

The tanker prices show considerable rises in the eleven-month period quoted. The average for all the types shown is just above 16 %. However, detailed analysis of contract prices undertaken by an independent consultant on behalf of the Commission shows that this is far too optimistic and does not reflect the actual level of prices of contracts placed over this year. For example, the price level shown for a Suezmax at 52,0 Mio. USD is far higher than any Suezmax price yet seen in South Korean shipyards.

Bulk carrier price rises are generally indicated as rising less, with the overall average rise being 3,4 % over the period shown. The biggest rise is shown for capesize ships and again this is regarded as over-optimistic when compared with the results of the detailed contract price analysis carried out for the Commission.

For the specialist shiptypes the most significant sector in relation to the South Korean industry is container ship construction, where Clarkson Research indicates an average price rise of just under 10 % over the year. Again, this does not concur with the detailed analysis of contracts taken in South Korea, as discussed later in this report. It should also be noted that Clarkson Research does not cover the segment of the very large containerships where most of the market activity took place in 2000 and therefore the price information given by Clarkson Research has to be seen as incomplete in that respect. The price level indicated by Clarkson Research for a LNG tanker is difficult to understand in that no price at that level has so far been seen from a Korean or any other shipyard.

In the search for explanations for the significant price drops for newly built ships productivity increases which are estimated to be at maximum 5-7 % per year or by break-through innovations as they can be observed, for example, in the IT industry, cannot provide the answer. Ships are large scale capital goods with a life expectancy of up to 30 years. Investments are carefully considered and technical innovation is in general evolutionary, i.e. the shipping industry rarely takes the risk to order a completely untested design. Comparing the price levels before the Asian crisis of 1997 with today's levels shows that the price drop has not been recovered. The initial justifications for the significantly lower prices given by Korea (WON depreciation, lower wages, longer working hours, massive annual productivity increases) have mostly lost their significance, leading the Commission to doubt that current price levels are commercially viable. For comparison purposes, prices pet shiptype as found through the Commission's detailed price monitoring on a contract by contract base are also available. As the following figures indicate, price levels in 2000 were still significantly lower than before the Asian financial crisis.

Table 3 - Comparison of price levels in 1997 and 2000 for certain shiptypes

| |

1997

(*) |

End 2000(*) |

Change in % |

2000 (**) |

Change in % |

| Panamax Container Carrier 3 500 TEU |

53,0 |

41,5 |

-21,7 |

38,0 |

-28,3 |

| 1 100 TEU Container Carrier |

20,0 |

18,0 |

-10,0 |

N/A |

- |

| Very Large Crude Oil Carrier (VLCC) |

83,0 |

76,0 |

-8,4 |

70,0 |

-15,7 |

| Suezmax Tanker |

52,0 |

52,0 |

0,0 |

43,0 |

-17,3 |

| Capesize Bulk Carrier |

40,5 |

40,0 |

-1,2 |

39,0 |

-3,7 |

| Panamax Bulk Carrier |

27,0 |

22,0 |

-18,5 |

22,0 |

-18,5 |

| Liquid Natural Gas Carrier |

230,0 |

172,5 |

-25,0 |

155,0 |

-32,6 |

| Tweendecker 15 000 dwt |

16,5 |

13,8 |

-16,4 |

N/A |

- |

Source: Clarkson World Shipyard Monitor(*), Commission (**).

In summary the prices indicated in the Clarkson monthly report do not concur with the findings of detailed research on a contract by contract basis undertaken for the Commission. Details of this research are given below. A more specific critical analysis of the approach used by Clarkson Research was already provided in the third shipbuilding report and is not repeated here.

2.3. Detailed price analysis

Prices in South Korean shipyards have been monitored on a contract by contract basis to gain a more accurate picture of developments than is available from commercially published statistics, The results are presented below in the form of indices that compare current price levels with the average level prevailing in the twelve months prior to April 2000 (index=100), or in other words comparing current prices to the level prevailing prior to the signing of the "Agreed Minutes" between the EU and South Korea.

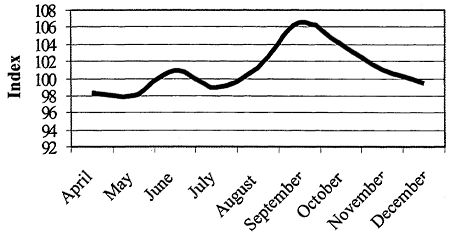

The overall index is presented in Figure 3, showing average movement for all shiptypes in all shipyards in South Korea.

Fig. 3 - Overall price index for South Korean shipyards

The graph clearly shows that the upward tendency of prices seen in autumn 2000 was not sustained. As already explained in the third report on shipbuilding, various developments came together at the time: Tankers and bulk carriers benefited from a healthy transport market, and the subsequent demand for new ships drove up prices. This effect was more pronounced in the case of tankers, as the market had started to anticipate the impact of the forthcoming new EU legislation and IMO rules on an accelerated phasing-out of existing single hull tankers. A currently good market for smaller tankers and the fear that, when the legislation has come into force, prices will be significantly higher, has triggered demand with the result that yards have been able to ask higher prices for these shiptypes. With limited availability of building slots for early delivery in Korean yards and EU yards not able to compete at these still very low, commercially non-viable price levels, owners need to pay a premium compared to 1998 and 1999. Prices for container ships increased in the first half of 2000, but have since fallen back somewhat, partly because freight rates have not rebounded as is the case with liquid bulk cargo, and the growth in vessel size provides a new economy of scale which allows companies to operate at comparatively low freight rates. In the meantime the freight rates in dry and liquid cargo shipping have also levelled off, resulting in fresh downward pressure on prices.

The Commission also analysed price trends for individual Korean yards. Depending on the typical product portfolio, the economic situation of the company and the resulting pricing policy, a picture emerges which reflects the strengths and weaknesses of the particular yard. While Samho Heavy Industries, now under management control of Hyundai Heavy Industries, has managed to increase prices significantly (although the previous price levels were extremely low and current price levels are still under the Korean average), Hyundai Heavy Industries themselves, and in particular Hyundai Mipo, could not sustain higher price levels and have actually fallen back behind the price levels of early 2000. Hanjin Heavy Industries and Construction, already in previous reports considered a comparatively prudent operator, managed to increase price levels in a sustained manner, indicating that the selective intake of orders and the core business of providing ships for the parent company, Hanjin Shipping. have paid off.

The Commission's detailed price analysis leads to the conclusion that overall price levels have not recovered and are still significantly lower than before the Asian crisis of 1997. There are no indications that Korean shipbuilders managed to raise price levels across the board as repeatedly announced. Therefore the Commission maintains its view that significant over-capacities in South Korean shipbuilding, combined with a permanent need to generate new orders in order to assure sufficient cash flow, prevent a recovery of prices and the market in general.

Not all major Korean yards have published their 2000 accounts yet. For those who did massive drops in profits or even losses are reported. Officially Korean yards claim high costs for disinvestment with regard to other chaebol subsidiaries (in particular those in the automotive and the construction sector) as the reason for the losses. It is, however, clear that the main reason has to be seen in very low order prices in 1998 and 1999 while building and delivery of the vessels took place under changed economic conditions in 2000 (wage increases, price inflation, WON appreciation). This development was forecasted by the Commission in its previous reports.

The allegations on Government intervention in the financing of the sector are being investigated in the context of an examination procedure under the Trade Barriers Regulation (Regulation 3286/94); a report to that effect will be submitted to the Member States at the end of May 200l.

In general, it appears that the economic situation of Korean yards has not improved. Daedong Shipbuilding Co. remains under court receivership, while Halla Heavy Industries and Daewoo Heavy Industries have been transformed into new companies, allowing them to restructure or shed their debts. The other major yards, Hyundai Heavy industries, Samsung Heavy Industries and, to a lesser extent, Hanjin Heavy Industries and Construction, have seen their profits reduced in 2000, followed by announcements that they will now focus on higher-value tonnage to make 2001 a more profitable year.