|

Challenges

The international shipbuilding market for oceangoing vessels today is relatively strong with production level reaching its highest level for 20 years, since a great number of large ships built in the 1970s are now due for replacement. In addition, as the phaseout of single-hull tankers is accelerating, a decent level of newbuilding demand can be expected in the short-term future. However while the supply capacity is likely to keep expanding with a capacity increase in newly emerging shipbuilding countries and a productivity rise in existing facilities, the demand is anticipated to fall from the middle of the 2000s onward. Therefore, it is feared that the supply-demand gap may widen in the future resulting in a further intensified international competition. Furthermore, the future of the shipping market is becoming increasingly unpredictable as the U.S. economy is slowing down and the tanker market is weakening. The stability of the shipbuilding market may suffer accordingly.

|

45,965DWT LPG carrier, Yuhsan, completed by Mitsubishi Heavy

Industries, Ltd.

|

| (拡大画面:111KB) |

|

|

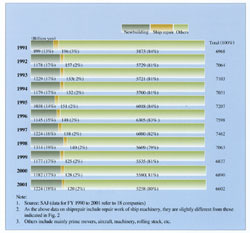

| Fig.4 Sales by divisions |

In order for major and medium-size builders of oceangoing ships to successfully survive international competition in the 2000s, an urgent challenge is to improve the structure of the industry so that it can meet diverse needs while strengthening its cost-competitiveness.

Meanwhile in the market for domestic coastal ships, smaller shipbuilders are facing difficult times as newbuilding demand for smaller vessels has plummeted reflecting a drop in cargo traffic caused by the national recession structural changes in product distribution networks and the reorganization of shipper industries. Tightening international control on fishing activities necessitating a cutback on the tuna fishing fleet is another negative factor. Therefore, these shipbuilders urgently need to strengthen their technological and financial bases and adjust their output to a sustainable level so that they can supply vessels compatible with the changing needs.

In order that shipbuilding remains a thriving industry for many decades to come, it is essential to develop new markets for shipbuilders through early commercialization of next-generation technologies including those for the Techno Superliner and the Mega-Float in addition to the construction of conventional oceangoing and coastal vessels.

Actions Taken

Restructuring of the Japanese Shipbuilding Industry

In the context of intensifying international competition in shipbuilding, the former Ministry of Transport in 1999 convened the meeting of an expert group on structural problems facing the Japanese shipbuilding industry and to find out what could be done to address the problems. The group released a report to the effect that major shipyards constituting the core of the nation's shipbuilding industry should enhance their cost competitiveness and diversify their business activities, and that this would require integration of business management to realize economies of scale at all stages of shipbuilding process including sales, design and procurement.

Since this report was published in the fall of 2000 noticeable moves towards industry realignment have been made by major shipbuilding companies, including comprehensive tie-ups in the shipbuilding sector and studies on possible spin-offs or mergers.

In June 2002, the Competitive Strategy Conference for the Shipbuilding Industry was set up with a view to helping keep the Japanese shipbuilding industry competitive in the world market. The newly established forum began analyzing the current status and problems facing the industry and studying what measures can be taken and how international issues can be effectively addressed.

|

| 60,587GT reefer cargo/car carrier (RCC), Sunbelt Spirit,

completed by Sumitomo Heavy Industries, Ltd. |

Measures for Smaller Shipbuilders

Smaller Japanese shipbuilders, mainly serving the market for coastal vessels and fishing boats, are suffering from seriously depressed demand due to the structural changes in coastal shipping reflecting the state of the national economy at large and successive cutbacks on the fishing fleet necessitated by the changing international situation of fishing. On the other hand, both qualitative and quantitative requirements regarding coasting ships are expected to substantially change reflecting the transformation of the nation's economic and employment structures and the rising environmental concern. Against this background, the following measures have been implemented in an integrated approach aiming to strengthen the industrial basis of smaller shipbuilders and keep them technically and financially able to supply vessels adapted to the changing requirements of society.

(a) |

Consolidation of management bases: Enhancement of technological capabilities, Reformation of business activities, and creation of new demand through projects for the consolidation of management bases under the Law for Supporting Reforms of Small- and Medium-Scale Companies. |

(b) |

Creation of new demand: Acceleration of replacement of government-owned ships among other things. |

(c) |

Maintenance and improvement of skills: Refining skills as they are handed

down from generation to generation. |

Commercialization of Techno Superliner

The Techno Super Liner (TSL) is a revolutionary ship developed with state support and capable of carrying large volumes of cargo at twice as fast as, or even faster than, a conventional cargoship. If and when TSLs enter commercial service and high-speed marine transport networks using them are created, the new means of transport will contribute to vitalization of regional economies, provide an alternative transport route in the event of a major disaster, help create new industries and new job opportunities, and exert positive socioeconomic impacts in other respects as well.

|

| 54,000GT pure car carrier (PCC), New Century 1, constructed

by Mitsubishi Heavy Industries, Ltd. |

At the same time, because of its entirely new technological features, the TSL is predicted to involve its own problems particularly higher construction, operating and maintenance costs than conventional ships. With an eye to overcoming these problems, it was decided to develop a scheme to support the commercialization of TSLs by (1) setting up a new ship holding and managing company to lease out TSLs to operators and thereby to lessen their initial investment, (2) working out an integrated technical support system covering different aspects of TSL operation including optimal operation management, and (3) facilitation of a building fund procurement.

Of these intended measures, establishment of the ship holding and managing company (Techno-Seaways Inc.) was realized in June 2002, with investments by shipping, shipbuilding, logistics and international trade interests together with the Development Bank of Japan. The construction of the first TSL is scheduled to start within this fiscal year, and its regular operation is expected to begin in the spring of 2005 on the route linking the Ogasawara Islands (located to the south of Tokyo) to the mainland.

|

| Over Panamax container carrier, MOL Performance, built by

Ishikawajima-Harima Heavy Industries Co., Ltd. (Present IHI Marine United Inc.) |

Promotion of International Cooperation

For shipbuilders operating in the international market to achieve harmonious development, it is indispensable to pursue international cooperation through developing a common understanding of the status of newbuilding supply and demand and establishing a fair competitive discipline. As a leading shipbuilding nation, Japan has been committed to international cooperation by taking initiatives in the OECD framework and elsewhere toward addressing the challenges facing the industry so that it can continue its contributions to the development of international society and economy. (For further details, see "International Cooperation")

|

| An image of Ogasawara TSL to be developed by Techno Seaways

Inc., a newly established company. |

|